What could seem like a valid signal to 1 dealer, may be a complete opposite signal to another trader. It really depends on what your particular person trading technique is and your objectives are. This flexibility permits you to be alerted to the most related buying and selling alternatives and then back take a look at them in opposition to historic patterns. This can give us a tough thought of how they might have performed traditionally but is after all not an indication or assure of future outcomes. The chart pattern-recognition capabilities of Autochartist are a big advantage of the software. Autochartist can analyse charts for numerous candlestick patterns, together with spinning tops, engulfing candlesticks, dojis and more.

One of its best advantages is the automation of technical evaluation, saving merchants vital time by automatically detecting and analyzing patterns like triangles, wedges, and Fibonacci retracements. This feature permits traders to focus extra on strategic decision-making quite than guide chart scanning. Additionally, Autochartist provides real-time alerts for rising and accomplished patterns, guaranteeing merchants can act promptly on potential buying and selling alternatives. The device also offers volatility analysis, which helps merchants perceive potential market risks and set appropriate autochartist signals stop-loss and take-profit ranges. Furthermore, its backtesting capabilities enable traders to evaluate the historical efficiency of patterns, refining their strategies based on previous data.

Further Features Available

Typically, there usually are not many Autochartist critiques available and it’s quite unusual knowing that they have existed since 2002. Many traders are reporting issues with Autocharting indicators, even the ones with higher profitable percentage potential. TradingView can be a good different that is extensively out there and offers automated buying and selling bots. It considers a wealth of historic information and macroeconomic elements, although what you do with this data is as a lot as you.

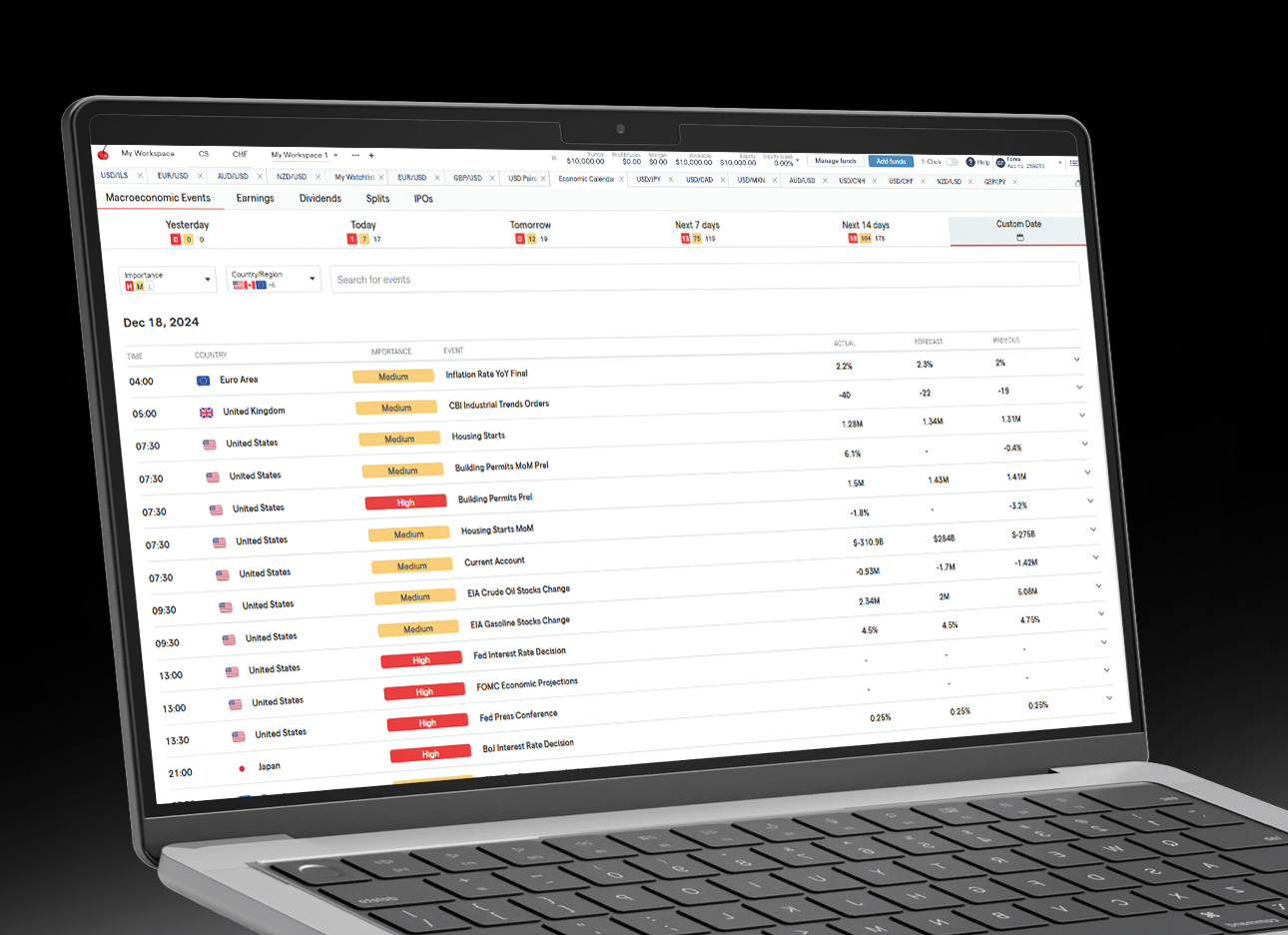

- Maintaining on top of the most recent financial information releases can be a essential a part of understanding what market movements you might anticipate to occur.

- By No Means miss a trading opportunity with personalised alerts for market actions, volatility, and upcoming macroeconomic events.

- Autochartist’s Technical Evaluation deciphers historical information to uncover potential value movements.

- Thus, speed and timing are integral to making sure your profitability and security in online buying and selling.

If you download the Autochartist software, you don’t have to worry about lacking information about the state of the market. As long as the web connection is clean, you can monitor value volatility even when you’re caught in traffic, ready in line at the financial institution, or doing different issues. Autochartist may be operated in 2 methods particularly by way of desktop and Android smartphone.

Autochartist can even provide you with a warning to trades that you may not have considered earlier than. As an example, it may establish that a foreign money pair (e.g. USD/JPY) has become highly risky following an announcement by the US Federal Reserve (Fed) or the Bank of Japan (BoJ). This signifies that https://www.xcritical.com/ you do not need to be sat at your desk and gazing at charts all day.

Pepperstone additionally provides cTrader and TradingView, where 50M+ social traders work together and share ideas Volatility (finance). AvaTrade provides glorious buying and selling platforms and cheap commission-free buying and selling fees from 0.9 pips or $9.00 per lot. Besides MT4/MT5 for algorithmic merchants, with assist for Autochartist, merchants can use the proprietary WebTrader and mobile app AvaTradeGO.

Explore The Markets With Our Free Course

Streamline your trading with Autochartist, an automatic market evaluation tool that identifies chart patterns and key worth levels, providing real-time alerts and insights to enhance your trading technique. Autochartist is commonly used on the MetaTrader 4 (MT4) platform, and you’ll get it for free whenever you obtain MT4 from IG. Autochartist is a multi-language financial evaluation software that includes automated chart pattern recognition software program.

Enjoy Access To Premium Autochartist

Autochartist’s Volatility Analysis presents insights into real-time market fluctuations based mostly on historical data. Understand expected premarket volatility variations by day and time and obtain Volatility Influence Warnings of potential spikes from forthcoming financial events. CFD buying and selling may not be suitable for everybody and may find yourself in losses that exceed your deposits, so please contemplate our Risk Disclosure Notice and ensure that you totally understand the risks concerned. 75% of retail investor accounts lose cash when trading CFDs and 2.20% of retail investor accounts had positions closed due to margin call, over the last 12 months. 75% of retail investor accounts lose cash when buying and selling CFDs, and 2.20% had positions closed because of margin calls over the last 12 months. Authochartist is a strong technical analysis device newbie and experienced merchants use to simply and mechanically spot market tendencies.

Autochartist for merchants is an entire market analysis pack, including feeds of technical and statistical events, financial news occasion evaluation, APIs, embedded parts and blog posts. There are content material and instruments that assist manage buying and selling threat via analysis of upcoming volatility. No Matter market or timeframe you want to commerce, the versatile Autochartist charting tool is more doubtless to support it. Autochartist can discover important support and resistance ranges, which are also identified as the building blocks of technical analysis.